International Tax Accountant to Professor

January 24, 2024

by Andrew Brajcich, CPA, JD, LLM

I have been very fortunate in my career. I was working in international tax and enjoying every aspect of it, except maybe billing. I had no plans to change. I loved what I did and with whom I worked. Then, through some undeserved luck, I fell into the only job conceivably better than the one I had. That was 12 years ago when I joined academia.

I am fortunate today because I get to introduce students to a noble and worthy profession. At first the appeal of accounting is something akin to solving a puzzle. Everything balances nicely in the principles class. Homework can be like completing a crossword. As students rise to upper division coursework, the most honed recruiting system across campus kicks into high gear. Firms and the WSCPA visit campus, hold networking events, review resumes, and start the interview process. By junior year, accounting students are light years ahead of their peers

pursuing other fields of study when it comes to professional development. This doesn't happen on accident. It's the product of an intentional profession. One that recognizes its role in a functioning society and realizes the importance of developing the next generation. While much of what we do looks toward the past, accountants by nature plan for the future.

There's not an organization in the world without the need for someone with accounting acumen. I often tell students that they will never have trouble volunteering for a non-profit board and when they do, be prepared to receive an offer for the treasurer position. We have a skillset that few possess, but every organization needs. At times we work long hours but that comes with responsibility. We are a safeguard, a gatekeeper, the front line for the financial markets and a functioning tax system, and there's not a business decision of consequence

that doesn't require our input. I've traveled from London to New York to Seattle meeting a variety of business professionals in a variety of industries and nearly all advise students to take more accounting, regardless of their career goals. Today, accountants are playing an increasing role in measuring non-financial factors under the environmental, social and governance (ESG) umbrella. A background in accounting leads to a wide variety of advancement possibilities in accounting and other fields. I personally know of litigators, politicians, HR professionals, investors, and even a physician, all of whom credit accounting for much of their success. The CPA designation opens doors to advancement. Forty-four percent of CFOs hold a CPA designation.(1)

We all desire to have a positive impact in some way. Accounting is a tremendous vehicle in getting to a position that achieves this. I enjoy educating the next generation of accountants and encourage students to study accounting for this reason.

So why are fewer people choosing careers in accounting?

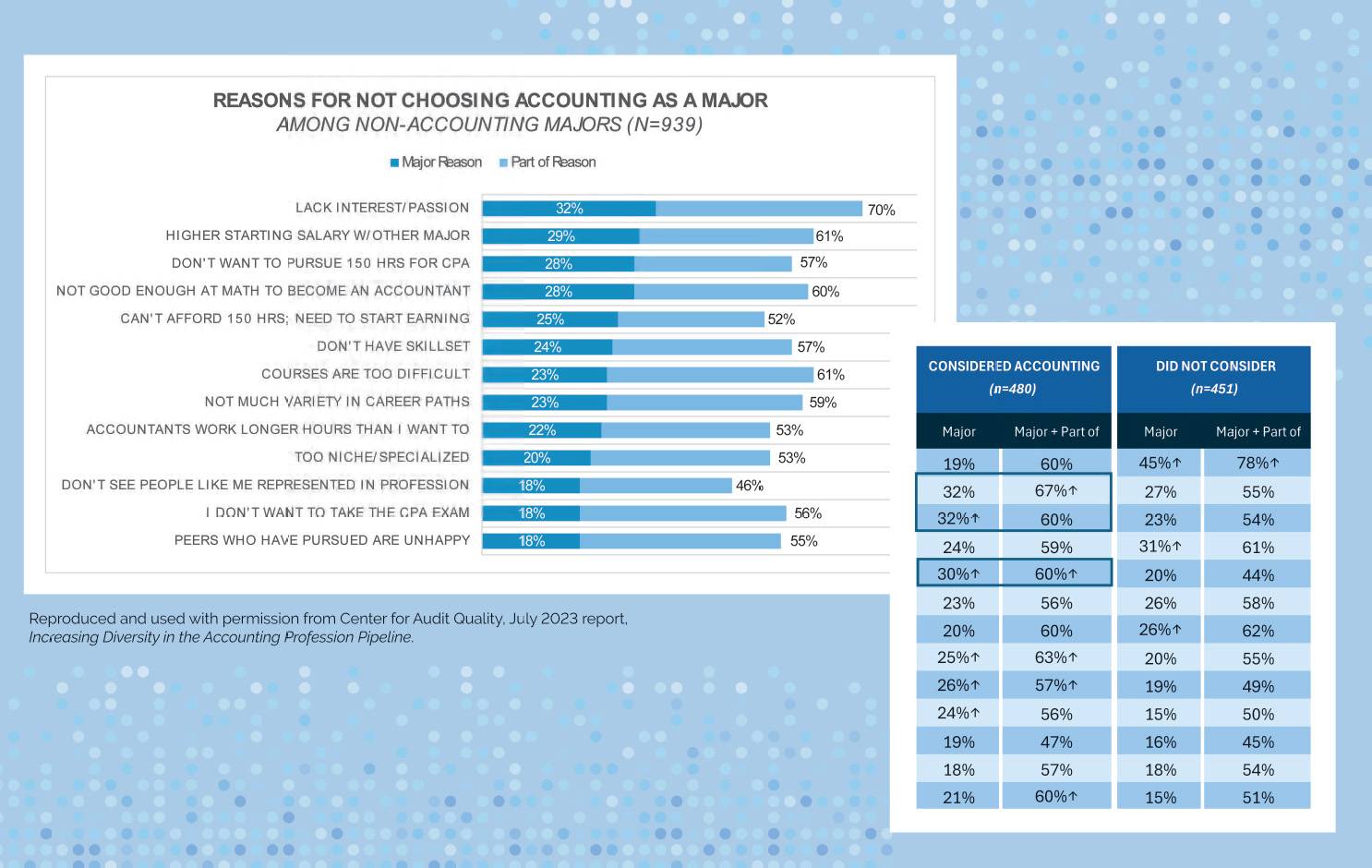

It's a question many are asking. I think the work done by the nonpartisan public policy organization Center for Audit Quality provides some of the best insights. The illustration below, Reasons for Not Choosing Accounting as a Major, is from its July 2023 report, Increasing Diversity in the Accounting Profession Pipeline. This report analyzes responses from over 1,800 students and recent graduates. An interesting misconception for me is "Not good enough at math to become an accountant." We don't do math. We do arithmetic.

For those at the WSCPA, this is not news. They've been at the forefront of addressing these issues for years. In fact, Kimberly Scott, WSCPA President & CEO, is among the select few to be serving on the AICPA's National Pipeline Advisory Group.

The WSCPA has long advocated for the profession in ways many do not realize. If they did, every CPA in the state would be a member. Their efforts have been critical in enhancing access to education, mentoring first generation college students, providing resources for professionals, and lobbying on behalf of the profession in Olympia and DC (To learn about the many ways the WSCPA is advocating every day, visit wscpa.org/advocacy.)

The WSCPA also provides networking opportunities, such as events throughout the state, for members. One event, held last October was so large that it required a change in venue. More than 100 students from area universities and community colleges attended the WSCPA Spokane Chapter's Boos and Brews trivia event.

For students looking to embark on a rewarding career in accounting, there is no better way to tap into an extensive knowledge base and network than to join the WSCPA. I encourage

my students to get involved with the WSCPA because it's an investment in their future and in the future of the CPA profession.

If you are ready to get more involved with the WSCPA this year, reach out via email and we'll help you find ways to engage.

Chair of the Board of Directors. Andrew Brajcich. CPA. JD. LLM. is the Jud Regis Endowed Chair of Accounting. Graduate Accounting Director. and Professor of Accounting at Gonzaga University. You can contact Andrew via email.

This article appears in the winter 2024 issue of the Washington CPA magazine. Read more here.